Agency Section

Customer Section

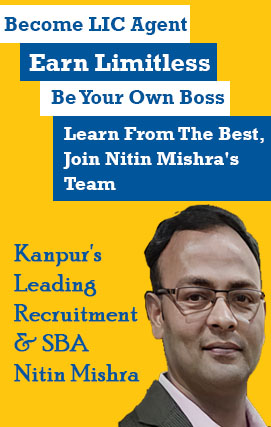

About Mentor

Nitin Mishra is a Senior Business Associate from LIC of India. He has created a Dedicated Team of More than 100 well Professional Advisors who are performing better year after year. Nitin Mishra believes in Development & Grooming of his Team as well as full focus on the earnings of each & every individual. His team of agents comprises of people of all age groups. There are agents as young as 19 Years of age and as old as 75 years too. But the common thing between them is that they all are highly motivated and beaming with energy.

Know more

Why Insurance Agency Is Best Career

Highest Paid Profession

In The World

Unlike other professions where your monthly income is fixed, in insurance agency business there is no such limits. You can earn as much money as you want depending on the business you do.

Earn By Help & Securing Others

As a life insurance advisor you are not only securing a person's financial goals but also protecting a family from financial pitfalls in case of unfortunate events like death or disability due to accident. Hence it is a very noble profession.

Economic Development Of The Country

As an LIC advisor the premium you bring in is used by LIC for socio-economic welfare and infrastructure building like bridges, dams, power plants etc. LIC is one of the biggest contributor to India's 5 year plans right from inception.

Benefits Of Insurance Agency

Earn Unlimited Income

Top LIC Agents are earning over 4 Crores yearly.You too can earn as much as you want. There is no limit.

Interest Free Advance

LIC offers interest Free Advance For Car, House, Office, Computer, Marriage and Many More benefits to its club members.

Work As Per Your Time

You have complete freedom to choose your work timings unlike regular jobs which have a fixed timing.

Be Your Own Boss

Become The Employer Not The Employee. You dont have to take instructions from anyone or work below others. You have complete freedom to work as you wish.

National & International Recognition

Apart from monetary benefits LIC also offers recognition to performing agents in the form of Club Memberships with host of benefits. Top performing agents also get international recognition in the form of MDRT/COT/TOT which is a globally known standard of excellence.

Regular & Hereditary Income

Apart from higher commission in 1st and 2nd policy year, agents are eligible to yearly commision on regular policies. This ensures regular income as long as policy is in-force. In a case of the death of an agent, the commission payable to him shall be payable to the Nominee or Legal Heir of the Agent.

Gratuity Available

LIC offers Gratuity facility to agents as a reward for long term association. It is calculated at the eligible rate for each qualifying year for the first 15 qualifying years and at half the eligible rate for the subsequent 10 qualifying years.

Regular Training Process

LIC offers full training and regular support such as: 1) Professional Training through Seminars 2) Sponsorship for special Training Programs 3) Knowledge Dissemination of all LIC products 4) Effective Selling Skills 5) Innovative Marketing Strategies.

Why LIC

Why LIC ?

Join LIC as an Advisor For Successful Life.

Any one can Join LIC of India As An Insurance Advisor on Part Time or Full Time Basis.

1148811 Agents can’t be wrong Work of an advisor does not ends with the closing of a policy. The right work starts service after sales. Claim settlement plays a key role in ranking all insurers in life insurance sector.

Strong LIC Brand

You will be associated with one of the leading Life Insurance Company of the world. The brand image of LIC of India is huge, people in India identifies life Insurance as LIC only. Thus selling life Insurance policies for LIC of India is much easier.

Wide Range Of Products

We have different products catering to the differing needs of all segments of the society. These are basic insurance plans (whole life, endowment and money back), Term Assurance Plans, Unit linked plans, Pension Plans, Health plan, Variable Insurance Products etc.

Policies To Be Guaranteed

The sum assured of all policies issued by LIC of India including any bonuses declared in respect thereof and, subject to the provisions contained in section 14 the amounts assured by all policies issued by any insurer the liabilities of which have vested in the LIC of India under this Act, and all bonuses declared in respect thereof, whether before of after the appointed day, shall be guaranteed as to payment in cash by the Central Government. Under-Section 37 of LIC ACT, 1956

Professional Training

We Provide Our Lic agents Professional Training through Seminars and Sponsorship for special Training Programs.

Procedure To Become An Agent

1. Simple Registration Process: To become an LIC agent, you have to fill in a simple registration form available on the Contact Us page of our website. You can submit the documents mentioned at the bottom of this page later. Please also take a look at the Documents and Fees section of this page.

2. Online or Offline Training: Once you are through the registration process, you will have to go for Online or Offline Training of 25 hours. Upon completion of the training, you will be awarded with a training certificate. The training covers all the aspects of Life Insurance Business.

3. Examination: Further, you will appear a Pre-Licensing Online exam conducted by IRDA and obtain at least - 17 out of 50 Marks. The questions will be of objective type.

4. License: Upon passing the exam, you will be awarded a license by IRDA to work as an insurance agent. Then you will be appointed as an agent by our branch and now you will be a part of a team.

Know more